Category Archives for 2nd Guide – Working Money Investing Basics

Stock market trading halts explained

Stock market trading halts explained tells investors about trading halts. Trading halts can be a sign of big trouble, opportunity, or not much at all. But most stock halts are news-related. That news can be about the company or stock, market-related, or be due to regulator action. In all cases, superior investors can quickly learn the reason for a trading halt. Then they can take any needed action to minimize or avoid problems. As well, investors can find money-making opportunities in a trading halt or simply do nothing. Many times, during and after a trading halt, doing nothing is the very best course of action.

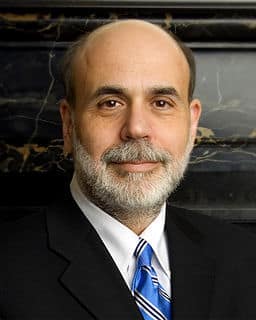

Read MoreFormer FED Chair, Ben Bernanke knows booming & busting

Fed Chairman Ben Bernanke has the answer: From the dawn of time the business cycle has boomed and busted. For any product or service we humans endlessly seemed destined to repeat the same pattern. Be it a company or economy we cycled endlessly through extremes of expansion and contraction.

Consider the possibility that Ben Bernanke knows the way to smooth this cycle and put prospects of greater prosperity back on the table.

5 Secrets of No-Worry Investors

5 Secrets of no-worry investors are setting goals, acquiring knowledge, making decisions, being patient, and minimizing risks and costs. Some no-worry investors manage their own portfolios, while others use the services of professional advisors. But all no-worry investors produce excellent long-term investment results! And you too can succeed by learning and following no-worry investing!

Read MoreFED billions bounced depression

FED billions bounced depression possibilities in 2008 to save the world economy! Doing that was FED Superhero Ben Bernanke, then US central bank Chair. He used massive Quantitative Easing (QE) or massive long-term financial stimulation to bounce the depression monster!

Read MoreWarren Buffett explains gold

Warren Buffett explains the investment value of gold. He points out the key difference between productive and non-productive assets. Wealth building investors buy productive assets. But gold is not a productive asset for investors.

Read MoreInvesting can be fun, interesting and slow

Learning to invest well can be fun, interesting and manageable. It just can’t be fast. It does take time. An hour a week can be used to learn but an hour a day can be put to very good, interesting and profitable use to learn, select and manage a portfolio well.

Read More3 Yeses or no investment

3 Yeses or no investment! Superior investors say no to investing unless the economy, market, and company all say yes. Waiting for three yeses aligns the odds in their favor by avoiding the common error of missing the market and economic signals. By knowing the importance of the economic, market, and company facts, investors give themselves a huge advantage. And they play that advantage by waiting for the three yeses before investing.

Read MoreInvestment impatience destroys wealth

Investment danger impatience zaps wealth. Let rising stocks add to your wealth. Early selling takes away all your upside potential wealth.

Read MoreAvoiding Costly Investing Mistakes

6 Sins of new investors, introduces 6 common investing sins and opens a seven part White Top View series, Playing Market Odds. The investing sin list: making investments based only on a media report, investing without research, holding investments that are losers, investing in turnaround or bankrupt companies, averaging down by buying more of a loser, not learning about or paying attention to investments. These 6 investing sins of beginners are mistakes that have the nasty habit of being costly. We learn about them, avoid them and quickly correct the mistakes we make.

Read MoreJoin exceptional wealth builders!

Why be normal? Be an exceptional investor! Why be normal when you can choose to be exceptional. That applies to everything you thing and do as well as investing so choose to be exceptional. Learning to invest, thinking and doing can produce exceptional results.

Read More